A father and child duo from Leicester scammed chauffeur out of more than ₤ 60,000 by offering worthless cars and truck insurance coverage that left lots uninsured.

Ilyas Rauf charged unsuspecting consumers approximately ₤ 300 for invalid policies, which left motorists facing possible fines and lorry seizures, while secretly sharing countless pounds with his son Amer Ilyas.

In the rip-off, fake insurance middlemen will claim they can get you cars and truck or home insurance coverage as a discount rate.

They may either turn over a fake policy or an authentic one, which they consequently cancel to keep the refund for themselves.

Alternatively, they get a real policy with inaccurate details to bring the premium down - which would likely leave it void must you attempt to make a claim.

Rauf, 51, made ₤ 61,763 from August 2016 to January 2020 by providing forged employment letters to secure discounted premiums for his victims.

Between September 2019 and June 2020, he shared more than ₤ 11,000 of his profits with his 28-year-old child, who was offered the task of hiring victims through social media.

The dad and child were sentenced at Leicester Crown Court for scams offenses

The National Crime Agency formerly shared a series of mocked-up Instagram advertisements offering '100% legitimate insurance coverage ensured to beat any cost' to reveal chauffeurs what to keep an eye out for

An examination discovered he utilized letters from a company called Eastern Catering to fraudulently get no claims discounts.

He falsely claimed his customers had worked for the company for numerous years without crashes or insurance coverage claims.

It was later found that the address Eastern Catering was registered to was the very same utilized by Rauf to offer the fake policies.

Police found that his son had actually also messaged 31 contacts about insurance coverage on his phone in between October 2015 to March 2021, typically informing customers that his daddy would provide quotes for them the next day.

Amer Ilyas would then inform victims to visit the workplace or send out images of bank cards for processing of payment.

Rauf was connected to 52 fraudulent motor insurance plan across four different insurance providers.

Ilyas Rauf's sibling Ziaed was captured on CCTV removing two computers from the workplace while cops robbed his nephew's home.

Four telephone call had been made in between the bros before Ziaed Rauf unsuccessfully attempted to obstruct a CCTV camera and got away.

Ziaed was captured on CCTV removing 2 computers from the workplace while authorities robbed his nephew's home.

Ziaed Rauf unsuccessfully attempted to obstruct a CCTV electronic camera and fled

How to avoid coming down with 'ghost brokers'

Karl Parr, from AXA UK, stated clients can secure themselves by following the below recommendations:

• Stay away from acquiring insurance coverage promoted through social media platforms and instantaneous messaging apps.

• Be careful of insurance coverage brokers who market their services in private community online forums or through ads in public places like pubs, cafes or newsagents.

• Don't engage with insurance coverage brokers who ask for payment in cash or through bank transfers. Reputable brokers will offer payment options via an online portal.

• Avoid insurance brokers who use personal email addresses or cellphone numbers to sell policies.

• If you're fretted about a policy you've purchased or the details don't look right, get in touch with the insurance provider straight - don't utilize the information offered by the broker.

• To guarantee you're handling an authorised insurance broker, check the Financial Conduct Authority's site or the British Insurance Brokers' Association websit.

Advertisement

Their fraud was revealed when financial private investigators discovered that he e declared to have actually earned ₤ 27,366 from 2016 to 2020 in spite of stealing more than ₤ 61,000 from the insurance fraud alone.

When questioned by police, his child told officers he could not remember being provided cash by his dad and declared he did not understand what it was for.

The 3 guys appeared at Leicester Crown Court on Friday, June 6.

Ilyas Rauf, 51, of Normanton Road, Highfields, Leicester, pleaded guilty to scams by incorrect representation, breaching the Financial Services and Markets Act and transferring criminal residential or commercial property and was imprisoned for 21 months.

Amer Ilyas, 28, also of Normanton Road, pleaded guilty to money laundering offenses and was given 16 weeks jail time, suspended for 12 months. He was also purchased to complete 100 hours of unsettled work.

Ziaed Rauf, 47, of Thurnview Road, Evington, Leicester, was given 18 weeks imprisonment, suspended for 12 months, and was purchased to complete 120 hours of overdue work after pleading guilty to perverting the course of justice.

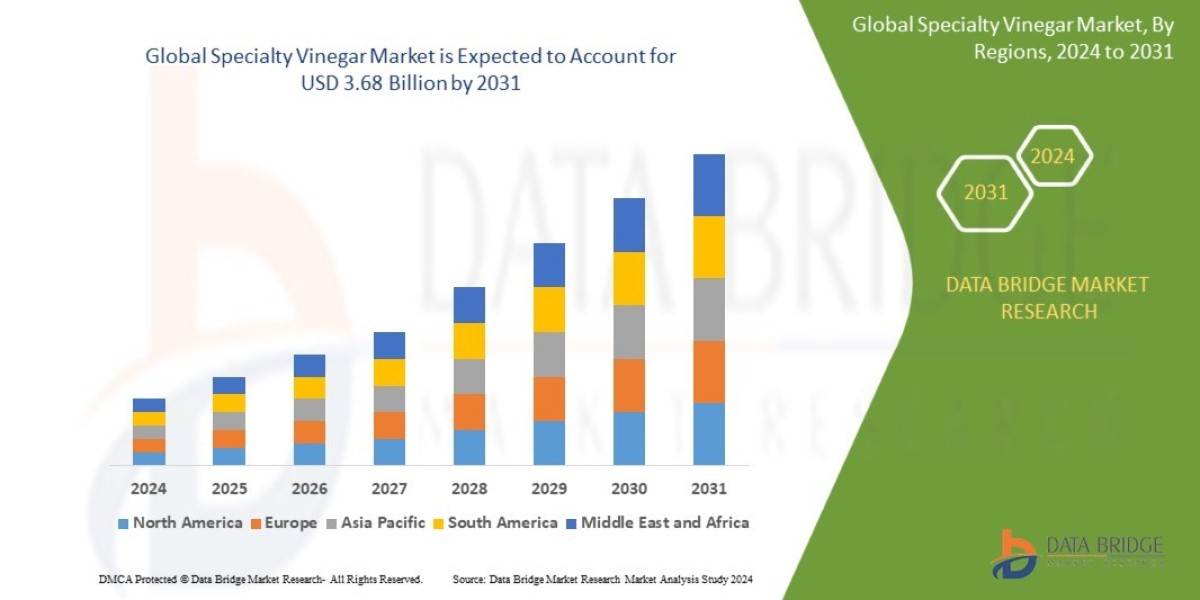

The most recent figures from the Association of British Insurers (ABI) reveal the cost of the average vehicle insurance coverage policy in January to March 2025 was ₤ 589, a 6 per cent drop from the year before.

However, premiums remain more costly today than two years ago, with the average policy ₤ 478 in January to March 2023 - 23 percent less than the very first quarter of 2025.

It follows a significant increase in social media and email hacking reports last year, according to Action Fraud.

A total of 35,434 reports were made to the scams and cyber criminal offense reporting service in 2024, compared to 22,530 in 2023.

Hacking approaches consist of fraudsters getting control of an account and impersonating the owner to persuade others to reveal authentication codes.

The rip-offs, called 'ghost broking' are often marketed on social media, appealing inexpensive quotes for a car insurance coverage policy.

Car insurance plan have actually dropped over the in 2015, however are still stay historically high

The automobile insurance coverage prices quote that ARE too good to be real: Warning over surge in 'ghost brokers'

Many victims think they are being messaged by a friend.

The most typical intentions for social media hacking were investment fraud, ticket scams or theft, Action Fraud said.

Fraudsters can also acquire account information by means of phishing frauds or information breaches.

People frequently utilize the exact same password throughout accounts, so when one is leaked a number of accounts are left vulnerable.

Action Fraud has actually introduced a project, supported by Meta, to motivate people to take additional online security by making it possible for two-step verification.

Victims typically don't realise they have actually been scammed till they try to claim on their policy or if they take place to be dropped in cops and asked to show their insurance coverage files.

Karl Parr, Claims Technical Director, AXA UK, told MailOnline: 'Ghost brokers typically use premium prices far more affordable than clients can discover somewhere else.

'Remember, if something sounds too excellent to be true, it almost certainly is.'

Young chauffeur Wayne Simpson purchased a cheap cars and truck insurance plan on social networks before realising it was fake after he was unable to claim following a crash, landing him with a loss of ₤ 500.

Young driver Wayne Simpson purchased a low-cost cars and truck insurance policy on social networks before realising it was fake after he was not able to claim following a crash, landing him with a loss of ₤ 500

'We called up Aviva and they informed me there wasn't a policy gotten in my name and that the number we had provided them was not a number they would utilize,' he told Sky News.

'That's when the dust settles, and you realise it's been a rip-off.'

Mr Simpson stated the insurance coverage files looked so genuine that they handled to deceive a law enforcement officer at the scene of the crash.

'She stated," Your automobile's not popping up as insured". Straight away I went to my glove box, pulled the insurance files, revealed her the documents and she checked out through it and stated," That's totally fine",' he said.