Executive Summary Cryptocurrency Banking Market :

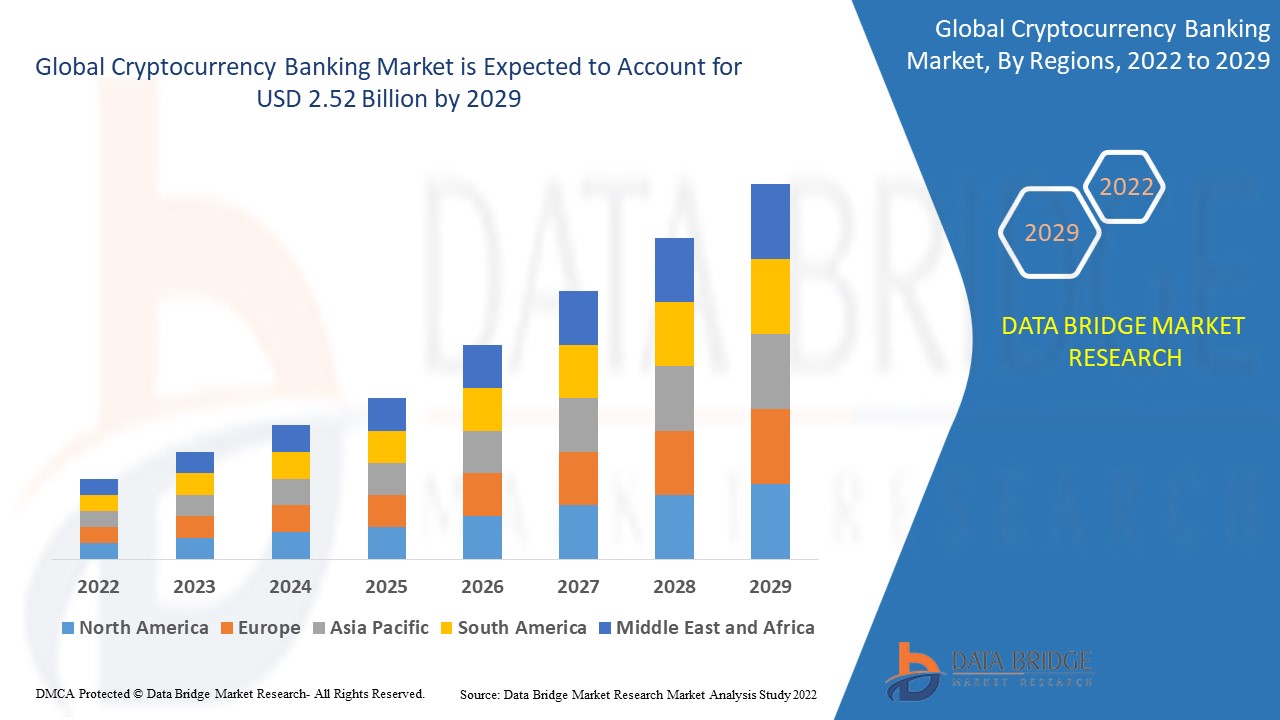

Data Bridge Market Research analyses that the cryptocurrency banking market was valued at USD 1.49 billion in 2021 and is expected to reach the value of USD 2.52 billion by 2029, at a CAGR of 6.80% during the forecast period

The research and analysis carried out in this Cryptocurrency Banking Market report helps clients to predict investment in an emerging market, expansion of market share or success of a new product with the help of global market research analysis. This market report is also enriched with historic data, present market trends, market environment, technological innovation, upcoming technologies and the technical progress in the related industry. By utilizing few steps or a number of steps, the process of formulating this Cryptocurrency Banking Market research report is started with the expert advice. This Cryptocurrency Banking Market research report offers the best and professional in-depth study on the existing state for the industry.

With the specific and high-tech information provided in this report, businesses can get idea about the types of consumers, consumer’s demands and preferences, their perspectives regarding the product, their buying intentions, their response to particular product, and their varying tastes about the specific product which is already present in the market. All the statistical and numerical data that has been estimated in this Cryptocurrency Banking Market report is represented with the help of graphs, charts, or tables which makes this report more user friendly. Complete compilation of company profiles that are driving the market is also performed in this report.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Cryptocurrency Banking Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-cryptocurrency-banking-market

Cryptocurrency Banking Market Overview

**Segments**

- Based on type, the global cryptocurrency banking market can be segmented into centralized, decentralized, and hybrid. Centralized cryptocurrency banking involves a single point of control and authority, offering more traditional banking services. Decentralized banking operates through blockchain technology, allowing users to have more control over their assets without the need for a central authority. Hybrid banking combines elements of both centralized and decentralized models, offering a balance between security and user control.

- By application, the market can be segmented into personal use, business use, and investment. Personal use of cryptocurrency banking includes everyday transactions, peer-to-peer transfers, and savings. Business use involves utilizing cryptocurrency banking services for payroll, invoicing, and international transfers. Investment in cryptocurrency banking refers to trading, holding assets, and participating in token sales.

- Geographically, the global cryptocurrency banking market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America leads the market due to the presence of major cryptocurrency players, favorable regulations, and increasing adoption of digital assets. Europe follows closely behind, with countries like Switzerland and Malta becoming cryptocurrency hubs. Asia Pacific is also a key region for cryptocurrency banking growth, driven by countries like Japan and South Korea embracing blockchain technology.

**Market Players**

- Some of the key players in the global cryptocurrency banking market include Coinbase, Binance, Bitfinex, Kraken, Gemini, Bitstamp, Huobi, and Bittrex. These cryptocurrency exchanges offer banking services such as digital wallets, trading platforms, and custodial solutions. Coinbase, one of the largest players in the market, provides a user-friendly interface for buying, selling, and storing cryptocurrencies. Binance, known for its wide range of trading pairs and low fees, has gained popularity among traders worldwide. Bitfinex and Kraken are also prominent exchanges offering advanced trading features and high liquidity.

- Additionally, traditional financial institutions like JPMorgan Chase, Goldman Sachs, and BBVA have started exploring cryptocurrency banking services. These legacy banks are looking into integrating blockchain technology for faster cross-border transactions, secure digital asset storage, and tokenization of assets. This trend indicates a convergence of traditional banking and cryptocurrency services, as the demand for digital financial solutions continues to rise.

The global cryptocurrency banking market is experiencing a rapid evolution driven by the adoption of digital assets and blockchain technology. One emerging trend in the market is the increasing popularity of decentralized finance (i) platforms, which are disrupting traditional banking services by offering decentralized lending, borrowing, and trading without the need for intermediaries. i projects like Compound, Aave, and Uniswap are gaining traction among users seeking more transparent and permissionless financial services. This shift towards i could potentially reshape the landscape of cryptocurrency banking, challenging centralized institutions and fostering innovation in the sector.

Another significant development in the market is the rise of regulatory frameworks governing cryptocurrency activities. Regulators worldwide are taking steps to clarify the legal status of cryptocurrencies and establish guidelines for businesses operating in the space. Countries like the United States, Japan, and Switzerland have implemented licensing requirements for cryptocurrency exchanges and custodians to enhance consumer protection and prevent money laundering. Clearer regulations could help foster trust in the cryptocurrency banking sector and encourage more traditional investors to participate in the market.

Moreover, the integration of blockchain technology into various industries beyond finance is creating new opportunities for cryptocurrency banking services. Sectors like supply chain management, healthcare, and real estate are exploring the use of blockchain for secure data management, transparent transactions, and streamlined processes. As blockchain adoption grows across different sectors, the demand for cryptocurrency banking solutions that offer seamless integration with blockchain networks is expected to increase. This presents a dynamic landscape for market players to innovate and develop tailored services for diverse industry verticals.

Furthermore, the scalability and interoperability challenges facing existing blockchain networks are prompting the development of solutions like layer 2 protocols and cross-chain interoperability technologies. Layer 2 solutions such as Ethereum's Optimism and Polygon are aiming to improve transaction throughput and reduce fees on blockchain networks, making them more efficient for everyday use cases. Cross-chain interoperability projects like Polkadot and Cosmos are working towards enabling seamless communication between different blockchains, facilitating asset transfers and data sharing across disparate networks. These advancements could enhance the usability and accessibility of cryptocurrency banking services, paving the way for broader mainstream adoption.

In conclusion, the global cryptocurrency banking market is poised for continued growth and innovation as blockchain technology revolutionizes financial services and industry sectors. The convergence of i platforms, regulatory frameworks, blockchain integration, and scalability solutions is reshaping the way users interact with digital assets and access banking services. Market players that can adapt to these evolving trends and address the changing needs of consumers and businesses are likely to thrive in this dynamic landscape.The global cryptocurrency banking market is currently undergoing a significant transformation driven by various trends and developments. One key trend shaping the market is the increasing popularity of decentralized finance (i) platforms. These platforms offer decentralized lending, borrowing, and trading services without the need for traditional intermediaries. The rise of i is challenging traditional banking models and fostering innovation within the cryptocurrency sector. Projects like Compound, Aave, and Uniswap are gaining traction, indicating a shift towards more transparent and permissionless financial services.

Moreover, regulatory frameworks governing cryptocurrency activities are evolving globally. Regulators in various countries are establishing guidelines to clarify the legal status of cryptocurrencies and enhance consumer protection. Clearer regulations could instill trust in the cryptocurrency banking sector and attract traditional investors to participate in the market. Countries like the United States, Japan, and Switzerland have already implemented licensing requirements for cryptocurrency exchanges and custodians to combat money laundering and uphold compliance standards.

Furthermore, the integration of blockchain technology across different industries beyond finance is opening up new opportunities for cryptocurrency banking services. Sectors such as supply chain management, healthcare, and real estate are exploring blockchain for secure data management and transparent transactions. As blockchain adoption expands, the demand for cryptocurrency banking solutions that seamlessly integrate with blockchain networks is expected to rise. This presents a diverse landscape for market players to develop tailored services for various industry verticals and drive innovation in the sector.

Additionally, scalability and interoperability challenges facing existing blockchain networks are driving the development of solutions such as layer 2 protocols and cross-chain interoperability technologies. Layer 2 solutions aim to enhance transaction throughput and reduce fees on blockchain networks, improving efficiency for everyday use cases. Projects like Polkadot and Cosmos are working towards enabling seamless communication between different blockchains, facilitating asset transfers and data sharing across diverse networks. These advancements have the potential to enhance the usability and accessibility of cryptocurrency banking services, accelerating mainstream adoption.

In conclusion, the global cryptocurrency banking market is poised for continued growth and innovation as blockchain technology reshapes financial services and industry verticals. The convergence of i platforms, evolving regulatory frameworks, blockchain integration across sectors, and scalability solutions signifies a dynamic landscape for market players to navigate. Firms that can adapt to these trends, address changing consumer and business needs, and drive technological advancements are likely to succeed in this rapidly evolving market environment.

The Cryptocurrency Banking Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-cryptocurrency-banking-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Table of Contents:

- Cryptocurrency Banking Market Overview

- Economic Impact on Industry

- Competition by Manufacturers

- Production, Revenue (Value) by Region

- Supply (Production), Consumption, Export, Import by Regions

- Production, Revenue (Value), Price Trend by Type

- Market by Application

- Manufacturing Cost Analysis

- Industrial Chain, Sourcing Strategy and Downstream Buyers

- Cryptocurrency Banking Market Strategy Analysis, Distributors/Traders

- Cryptocurrency Banking Market Effect Factors Analysis

- Cryptocurrency Banking Market Forecast

- Appendix

Browse More Reports:

Global Polyvinyl Chloride (PVC) Market

Global Arteriovenous Malformations (AVMs) Market

Global Wireless Charging Market

Global Laser Welding Machine Market

Global Thermal Energy Harvesting Market

Global Head Up Display (HUD) Vehicle Infotainment Market

Global Pachydermoperiostosis Market

Global Phenolic Compounds Market

Africa Molecular Point of Care Testing (using NAAT) Market

Global Casein Protein in Animal Feed Application Market

Global Reishi Mushroom Extract Market

Middle East and Africa Palm Fiber Packaging Market

Asia-Pacific Animal Nutrition Market

Global Cholecystitis Treatment Market

Asia-Pacific Age-Related Macular Degeneration (AMD) Disease Market

Global Smart Carry-on Bags Market

Global Feminine Hygiene Products Market

Global Oculodentodigital Syndrome Market

Global Pro/Self-Hosted Master Card Market

Global Business Process Management Market

Global Centralised RAN (Radio Access Network) Market

Global Hybrid Video Surveillance Market

Global Osteosynthesis Devices Market

Asia-Pacific Panel Mount Industrial Display Market

Global Celtic salt Market

Global Airborne Wind Energy Market

Global Driving Apparel Market

Global Sarcoma Drugs Market

Global Neuraminidase Inhibitors Market

KSA Plastic Pipes Market

Global Enzyme-Linked Immune Absorbent Spot (ELISpot) Market

Global Electron Beam Linear Accelerator Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com