The global push toward sustainability is reshaping industrial and agricultural value chains, with lignin—a natural, abundant biopolymer—playing an increasingly prominent role. The global lignin market size reached about USD 1033.62 million in 2024. The market is further expected to grow in the forecast period of 2025–2034 at a CAGR of 2.00% to reach nearly USD 1259.98 million by 2034. This growth is propelled by expanding interest in renewable feedstocks, circular economy models, and eco-friendly alternatives to petrochemicals.

Lignin, primarily extracted as a byproduct from the pulp and paper industry, is gaining new relevance in sectors such as construction, agriculture, chemicals, and energy. Its functional properties—binding ability, antioxidant activity, and biodegradability—make it a promising component in adhesives, dispersants, carbon fibers, and even biofuels. As industries seek cost-effective, low-carbon materials, lignin is stepping into the spotlight as a sustainable substitute across multiple applications.

Expert Market Research

In navigating this complex and evolving sector, stakeholders rely on robust, data-driven insights provided by agencies like Expert Market Research (EMR). EMR offers in-depth analyses of the lignin market, covering segmentation by type, source, and application, alongside regional trends and competitive dynamics. With a comprehensive understanding of the market’s size, pricing trends, demand drivers, and future projections, EMR equips decision-makers with actionable intelligence. As the lignin market transitions from traditional byproduct usage to high-value applications, EMR’s market reports provide clarity for manufacturers, investors, and policy-makers looking to capitalize on the material’s renewable potential.

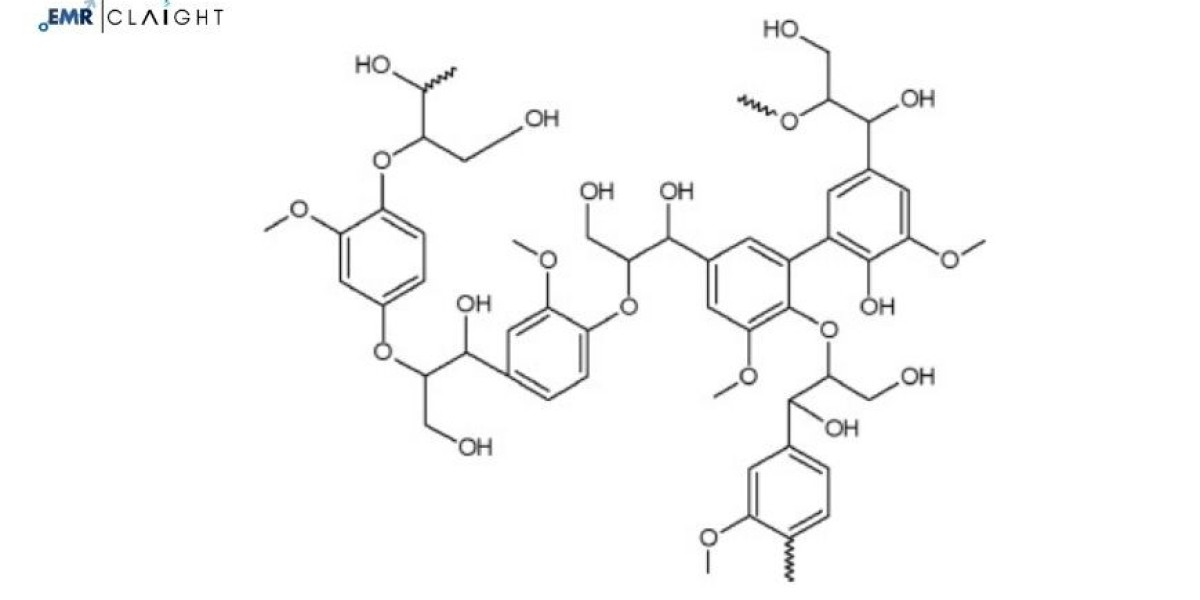

Understanding Lignin: Structure and Industrial Relevance

Lignin is the second most abundant natural polymer on Earth, after cellulose. Found in the cell walls of plants, it acts as a binding agent that gives structural integrity and resistance to microbial attacks. Commercially, lignin is obtained mainly from wood pulping processes through kraft, sulfite, or organosolv methods.

Despite historically being underutilized—often burned as low-value fuel in pulp mills—lignin is now seen as a valuable raw material for high-end applications due to its:

Aromatic content, suitable for replacement of petroleum-based chemicals

Biodegradability and non-toxicity, aligning with green chemistry principles

Abundance and renewability, providing scalability without environmental depletion

The lignin market is now diversifying beyond traditional uses, leveraging technological advancements to integrate lignin into adhesives, composites, coatings, and energy solutions.

Market Segmentation

The lignin market is segmented based on the type of lignin, its source, and its end-use application. Understanding these segments helps clarify its commercial potential and future direction.

By Type:

Kraft Lignin: A byproduct of the kraft pulping process; widely available and commonly used in high-performance applications like phenol replacement.

Lignosulfonates: Water-soluble lignin derivatives from the sulfite pulping process; used primarily as dispersants and binders in concrete and animal feed.

Low Sulfur Lignin: Suitable for applications requiring lower odor and reduced sulfur emissions, such as in resins and polymers.

Organosolv Lignin: Extracted using organic solvents; high purity and low ash content make it suitable for advanced material applications.

By Source:

Wood-Based Lignin (softwood and hardwood)

Non-Wood Lignin (agricultural residues such as straw, bagasse, and corn stover)

By Application:

Concrete Additives: Lignosulfonates act as water-reducing agents and dispersants, improving workability and strength.

Animal Feed: Used as binders and to enhance nutritional absorption.

Binders and Adhesives: Replacement for petroleum-based phenols in resin production.

Biofuels and Carbon Fibers: High-carbon content makes lignin suitable for next-generation fuels and structural materials.

Thermoplastics and Bioplastics: Added to polymers to enhance biodegradability and strength.

Agricultural Products: Soil conditioners and pesticide carriers.

Drivers of Growth in the Global Lignin Market

The modest but steady CAGR of 2.00% reflects a mix of industrial interest, environmental policy shifts, and technological evolution. Several drivers are pushing the lignin market forward:

Sustainability and Circular Economy Models

As industries seek alternatives to fossil-derived materials, lignin is gaining attention as a carbon-neutral, renewable feedstock. Its use reduces dependence on synthetic chemicals, aligning with global decarbonization goals.

Expanding Bio-Based Chemicals Industry

Lignin serves as a potential platform for bio-aromatics and green chemicals, which are in demand for sustainable adhesives, coatings, and surfactants.

Growing Construction Sector in Emerging Economies

Demand for lignin-based additives in concrete and cement is rising in regions like Asia-Pacific, where urbanization and infrastructure development are rapidly advancing.

Policy Incentives and Green Procurement

Environmental regulations encouraging the reduction of VOCs and hazardous chemicals are motivating manufacturers to explore lignin as a safer alternative.

Technological Advancements in Extraction and Processing

Improved pulping techniques and lignin fractionation technologies are enhancing the purity and functionality of lignin, making it more attractive for specialized applications.

Regional Market Analysis

The global lignin market is geographically diverse, with regional trends influenced by resource availability, industrial infrastructure, and policy frameworks.

North America

The U.S. leads in lignin R&D, particularly in bio-refinery and green chemical production. Government initiatives supporting sustainable materials and waste valorization are creating opportunities for lignin integration into chemicals and polymers.

Europe

Europe is at the forefront of the bioeconomy, with robust demand for lignin in advanced materials, composites, and bioplastics. Countries like Germany, Finland, and Sweden are investing heavily in lignin valorization as part of their green innovation strategies.

Asia-Pacific

The fastest-growing region, driven by increased industrial activity in China, India, and Southeast Asia. The pulp and paper industry is expanding, providing both the raw materials and demand for lignin applications in construction, agriculture, and animal feed.

Latin America & Middle East

Brazil, Chile, and parts of the Middle East are developing lignin applications within agriculture and construction, supported by abundant biomass resources and a growing interest in value-added byproducts.

Key Players in the Lignin Market

The global lignin market includes a mix of established chemical firms, biorefinery innovators, and regional producers. Leading companies include:

Borregaard ASA (Norway): A pioneer in lignosulfonates and specialty lignin derivatives.

Domtar Corporation (Canada/USA): Focused on kraft lignin applications and valorization.

Stora Enso (Finland): Investing in lignin-based resins and binders.

Domsjö Fabriker AB: Part of the Aditya Birla Group; specializes in high-purity lignin.

GreenValue SA (Switzerland): Active in commercializing lignin-based technologies.

The Nippon Paper Group: Researching lignin-based carbon materials.

Collaborations, public-private partnerships, and innovation ecosystems are common strategies used to explore new lignin use cases and commercialization paths.

Challenges and Market Restraints

Despite its potential, the lignin market faces several constraints:

Technical Limitations

Raw lignin is heterogeneous, with variability in structure depending on the source and extraction method. This inconsistency complicates formulation and standardization in high-value applications.

Market Awareness and Adoption

Many industrial sectors are still unaware of lignin’s functional capabilities. Education, testing, and validation are needed to increase adoption.

Price Competitiveness

Compared to low-cost petrochemical alternatives, high-quality lignin derivatives can be more expensive to process. Economies of scale and technology improvements are critical for price competitiveness.

Regulatory Barriers

While lignin is non-toxic, certain applications (e.g., food packaging or cosmetics) require rigorous testing and certification before commercialization.

Emerging Trends in the Lignin Industry

The lignin market is undergoing a transformation driven by innovation, regulatory alignment, and shifting consumer expectations. Key trends include:

Bio-Based Epoxy Resins

Lignin is being integrated into epoxy resin formulations used in automotive, aerospace, and electronics. These biobased alternatives reduce carbon footprints without compromising performance.

Lignin Nanoparticles

Nano-lignin particles are showing promise in drug delivery, coatings, and UV-blocking films. Their antioxidant and antimicrobial properties add functionality to packaging and biomedical materials.

Lignin as a Carbon Fiber Precursor

High-carbon content and renewable origins make lignin a potential raw material for lightweight carbon fibers, particularly in the automotive and aerospace sectors.

Functional Cosmetics

Natural antioxidants and UV protection capabilities are drawing interest from cosmetic companies looking for plant-based ingredients.

Future Forecast

The decade ahead will likely see lignin move beyond bulk uses toward high-margin, functional applications. By 2034, the market is projected to hit nearly USD 1259.98 million, underpinned by:

A global shift toward decarbonization and sustainability

Increasing demand for bio-based functional materials

R&D advances in fractionation and lignin upgrading

Expansion of lignin-based composites and polymers

Scaling of biorefineries and integrated production

Public funding, especially in Europe and North America, will continue to support lignin valorization, with emerging markets expected to catch up through industrialization and green manufacturing initiatives.

Media Contact

Company Name: Claight Corporation (Expert Market Research)

Contact Person: Chander Deep, Corporate Sales Specialist

Email: sales@expertmarketresearch.com

Toll Free Number: +1–415–325–5166 | +44–702–402–5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: https://www.expertmarketresearch.com