Executive Summary North America Fraud Detection Transaction Monitoring Market :

Executive Summary North America Fraud Detection Transaction Monitoring Market :

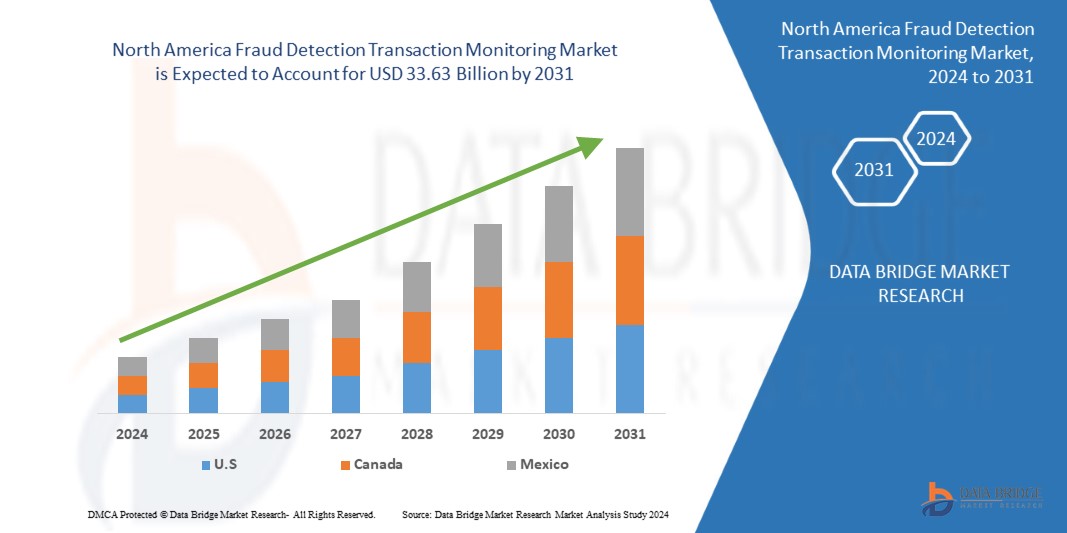

North America fraud detection transaction market is expected to reach a value of USD 33.63 billion by 2031 from 6.53 billion in 2023, growing at a CAGR of 22.9% during the forecast period 2024 to 2031.

In this North America Fraud Detection Transaction Monitoring Market report, industry trends are put together on macro level which aids in comprehending market place and possible future issues. This market report is an outcome of incessant efforts lead by clued-up forecasters, innovative analysts and bright researchers who indulge in detailed and attentive research on different markets, trends and emerging opportunities in the consecutive direction for the business needs. Estimations about the rise or fall of the CAGR value for specific forecast period, market drivers, market restraints, and competitive strategies are evaluated in the report. The report lends a hand to businesses so that they are able to make informed, strategic and therefore successful decisions for themselves.

The market report can be explored in terms of breakdown of data by manufacturers, region, type and application, market status, market share, growth rate, future trends, market drivers, opportunities and challenges, emerging trends, risks and entry barriers, sales channels, and distributors. Insights about granular analysis of the market share, segmentation, revenue forecasts and geographic regions of the market are also given in the report which supports business growth. This North America Fraud Detection Transaction Monitoring Market report makes available up-to-the-minute industry data, market future trends that allows to identify the products and end users driving revenue growth and profitability.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive North America Fraud Detection Transaction Monitoring Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/north-america-fraud-detection-transaction-monitoring-market

North America Fraud Detection Transaction Monitoring Market Overview

**Segments**

- **By Component**: The market can be segmented based on components into solutions and services. The solutions segment is further divided into fraud analytics, authentication, and governance, risk, and compliance (GRC). The services segment includes professional services and managed services.

- **By Deployment Mode**: In terms of deployment mode, the market can be categorized into on-premises and cloud. The cloud deployment mode is gaining popularity due to its cost-effectiveness and scalability.

- **By Organization Size**: Organizations are categorized based on size into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting fraud detection and transaction monitoring solutions to protect their businesses from financial losses.

- **By Vertical**: The market can also be segmented by verticals such as banking, financial services, and insurance (BFSI), retail, healthcare, government, and others. Each vertical has specific fraud detection and transaction monitoring needs, driving the demand for tailored solutions.

**Market Players**

- **SAS Institute Inc.**: SAS Institute is a key player offering fraud detection and transaction monitoring solutions. The company's advanced analytics capabilities help in identifying unusual patterns and behaviors to prevent fraudulent activities.

- **ACI Worldwide**: ACI Worldwide provides real-time fraud detection and prevention solutions to financial institutions and retail organizations. Their solutions offer real-time monitoring and analysis to mitigate risks effectively.

- **FICO**: FICO is renowned for its fraud detection and analytics solutions that leverage artificial intelligence and machine learning technologies. The company's solutions enable proactive fraud prevention and detection.

- **Oracle Corporation**: Oracle offers comprehensive fraud detection and transaction monitoring solutions that cater to various industries. Their solutions incorporate predictive analytics and behavioral profiling to combat fraudulent activities.

- **IBM Corporation**: IBM is a prominent player in the fraud detection market, providing cutting-edge transaction monitoring solutions. Their solutions utilize advanced algorithms and anomaly detection techniques to identify suspicious transactions.

In conclusion, the North America fraud detection and transaction monitoring market is experiencing significant growth due to the rising instances of fraud across various industries. The market is driven by the increasing adoption of advanced technologies such as AI and machine learning to enhance fraud detection capabilities. Key players like SAS Institute, ACI Worldwide, FICO, Oracle Corporation, and IBM Corporation are at the forefront of offering innovative solutions to address the evolving fraud landscape in the region.

The North America fraud detection and transaction monitoring market continues to evolve rapidly, driven by the increasing sophistication of fraudulent activities and the growing need for robust security measures across industries. One of the emerging trends in the market is the integration of advanced technologies such as blockchain and biometrics to enhance security and authentication processes. Blockchain technology offers immutable and transparent transaction records, making it harder for fraudsters to manipulate data. Biometric authentication methods, such as fingerprint and facial recognition, provide an additional layer of security to prevent unauthorized access and fraudulent transactions. These technological advancements are reshaping the fraud detection landscape and improving the overall effectiveness of transaction monitoring systems.

Another key trend in the market is the emphasis on real-time monitoring and analysis capabilities to detect and prevent fraud in a timely manner. Real-time monitoring allows organizations to identify suspicious activities as they occur, enabling immediate intervention and mitigation of risks. By leveraging real-time data analytics and AI-driven algorithms, businesses can proactively identify potential threats and respond swiftly to prevent financial losses. This trend reflects the increasing focus on proactive fraud prevention measures to stay ahead of cybercriminals and safeguard sensitive information and assets.

Furthermore, the market is witnessing a growing demand for cloud-based fraud detection and transaction monitoring solutions due to their flexibility, scalability, and cost-effectiveness. Cloud deployments offer businesses the agility to scale their security infrastructure based on evolving needs and requirements. Additionally, cloud-based solutions provide seamless integration with existing systems and applications, enabling organizations to streamline their fraud detection processes and enhance operational efficiency. The shift towards cloud-based deployments underscores the industry's inclination towards scalable and adaptable security solutions that can keep pace with the dynamic nature of fraud threats.

Moreover, regulatory compliance requirements are driving the adoption of advanced fraud detection and transaction monitoring solutions across industries such as banking, financial services, and healthcare. Stringent regulations mandate businesses to implement robust security measures to protect consumer data and prevent fraudulent activities. As a result, organizations are investing in sophisticated fraud detection tools that can ensure compliance with industry standards and regulatory guidelines. The integration of compliance management features into fraud detection solutions enables businesses to meet regulatory expectations while fortifying their security posture against emerging threats.

In conclusion, the North America fraud detection and transaction monitoring market are characterized by rapid technological advancements, increasing emphasis on real-time monitoring capabilities, growing adoption of cloud-based solutions, and regulatory compliance pressures. As the threat landscape continues to evolve, organizations need to stay vigilant and invest in innovative fraud detection technologies to safeguard their operations and mitigate financial risks. By aligning with market trends and leveraging cutting-edge solutions from key players in the industry, businesses can proactively combat fraud and protect their assets in an increasingly digital landscape.The North America fraud detection and transaction monitoring market is witnessing dynamic changes driven by technological advancements, regulatory pressures, and shifting industry landscapes. One significant trend shaping the market is the integration of advanced technologies like blockchain and biometrics to enhance security measures. Blockchain technology's immutable and transparent nature is making data manipulation difficult for fraudsters, thus improving transaction security. Biometric authentication methods offer a secure layer of identity verification, reducing the risk of unauthorized access and fraudulent activities. The adoption of these technologies reflects the market's focus on bolstering fraud detection capabilities and ensuring robust transaction monitoring systems.

Real-time monitoring and analysis capabilities are emerging as a crucial trend in the market, enabling businesses to detect and prevent fraud promptly. By leveraging real-time data analytics and AI-driven algorithms, organizations can proactively identify and respond to potential threats in a timely manner, thus reducing financial risks. The emphasis on proactive fraud prevention measures signifies the industry's determination to stay ahead of cyber threats and safeguard critical assets and information. This trend underscores the importance of agility and responsiveness in combating fraudulent activities in a rapidly evolving digital landscape.

Cloud-based solutions are gaining traction in the North America fraud detection and transaction monitoring market due to their scalability, flexibility, and cost-effectiveness. Cloud deployments offer businesses the opportunity to adapt their security infrastructure to changing needs efficiently. The seamless integration capabilities of cloud-based solutions enable organizations to streamline their fraud detection processes and enhance operational efficiency. The shift towards cloud deployments indicates the industry's preference for scalable and adaptable security solutions that can keep pace with evolving fraud threats and regulatory requirements.

Furthermore, regulatory compliance pressures are fueling the adoption of advanced fraud detection and transaction monitoring solutions across industries like banking, financial services, and healthcare. Stringent regulations mandate businesses to implement robust security measures to protect customer data and mitigate fraudulent activities. As a result, organizations are investing in sophisticated fraud detection tools that ensure compliance with industry standards and regulatory guidelines. By integrating compliance management features into fraud detection solutions, businesses can align with regulatory expectations while strengthening their security posture against emerging threats.

In conclusion, the North America fraud detection and transaction monitoring market is undergoing a significant transformation fueled by technological innovations, real-time monitoring capabilities, cloud adoption, and regulatory compliance requirements. Businesses need to stay abreast of market trends and invest in innovative fraud detection technologies to mitigate financial risks effectively and safeguard their operations in an increasingly digital environment. By leveraging cutting-edge solutions from key market players, organizations can proactively combat fraud and protect their assets against evolving threats in the fraud landscape.

The North America Fraud Detection Transaction Monitoring Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/north-america-fraud-detection-transaction-monitoring-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Reasons to Consider This Report

- To understand the North America Fraud Detection Transaction Monitoring Market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for North America Fraud Detection Transaction Monitoring Market

- Efficiently plan M&A and partnership deals in North America Fraud Detection Transaction Monitoring Market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segments of cannabis seeds market

- Obtain market revenue forecasts for the North America Fraud Detection Transaction Monitoring Market by various segments in regions.

Browse More Reports:

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com